How We Helped a Family Pay Off $135,000 of Debt in 33 Months with Only $80,000 in Cash

The Problem

Living on the Brink of Bankruptcy With $135,000 in Credit Card Debt

In 2016, Angela and Robert Johnson came to Tier 1 Capital with a dire household debt situation. The Johnsons had over $135,000 in installment debt outside their mortgage, leading to 32% of their monthly income going toward debt payments. Despite a combined annual income of $120,000, Angela and Robert felt like they were drowning. With 13+ credit card payments piling up, bankruptcy had begun to look like their only way out.

In addition to the stress of their current situation, their oldest son was starting college in a year. The Johnsons wanted to help their son with college, but their existing payoff period was an estimated 131 months, over a decade into the future. Not only was their debt not going away anytime soon, but a significant portion of their debt payments—35.9%—was going toward interest alone.

Angela, who was in charge of paying the various credit card bills, had begun to despise gathering the mail every day because it inevitably held yet another bill they were responsible for. The stress of their financial situation had begun to take a toll on their day-to-day activities and their plans for the future. Retirement seemed like an impossibility, let alone helping their son pay for college.

Debt Is an Increasing Issue with Dire Consequences

Unfortunately, the Johnson’s situation is becoming more and more common. According to the Federal Reserve, total household debt is at a record high in the United States, reaching $16.9 trillion at the end of 2022. Credit card debt is also increasing at a record pace. Credit debt was up 6.6% from Q3 to Q4 of 2022, reaching $986 billion—the fastest quarterly growth rate ever recorded.

Not only is credit card debt becoming more ubiquitous, but health-related fallout from financial stress is also increasing. This stress has been linked to issues such as heart disease, diabetes, and mental illness. Indeed, 87% of people have lost sleep due to financial stress.

For the Johnsons, getting back in control of their income and making their savings more efficient was key if they wanted to get out of debt, avoid financial stress, and live the future they had always dreamed of.

Our Solution

Applying the Tier 1 Capital Growth Process™ to Recycle Payments & Regain Financial Control

When the Johnsons came to Tier 1 Capital, the first thing we did was clarify why their financial situation felt out of control. The Johnsons were clearly stuck in a debt cycle.

Consumer debt often feels like a massive hole you have to climb out of payment by payment. However, the real problem with consumer debt is that, even after climbing out of the hole, unless you can build capital aside from the debt, the next time you need access to capital, you’ll be forced right back down to the bottom again.

There’s only one way out of the debt cycle: You must build a financial asset you own and control, rather than giving away control to outside entities (such as credit card companies, banks, etc.).

Snowball Effect: The Tier 1 Capital Growth Process™

We combatted this cycle by applying the Tier 1 Capital Growth Process™ to the Johnson’s situation. We immediately started redirecting cash flows to new whole life insurance policies for both Angela and Robert. Then, using the cash value of those policies, we started paying off their debts from smallest to largest.

This created a virtuous cycle for the Johnsons—by borrowing against their life insurance policy instead of paying off debts with cash, they could reuse those payments later. In other words, Angela and Robert were now paying directly into their whole life policies instead of handing their cash to credit card companies.

A few things immediately started to happen:

- Capital Building: They started to build a pile of tax-free cash they owned and controlled through their life insurance policies.

- Debt Payoff: They started to regain control of their current debts by using the cash values on their whole life policies to pay off smaller debts first, then larger debts later.

- Payment Recycling: They were able to recycle the money used for their monthly debt payments from their policy cash values, leading to a quicker payoff of debts while also building a pool of capital.

Now, the Johnson’s cash reserve was snowballing in the opposite direction. They were filling up their pool of money with two hoses rather than one—one through their monthly debt payments, and one through their monthly premiums on their whole life policies.

If the Johnsons had gone with the traditional method of paying off their debts piece by piece, getting out of debt would have taken significantly longer than with our Growth Process.

In short, by applying our unique method, the Johnsons were able to shore up a pool of money they owned via premium deposits on their whole life policies AND via their monthly debt payments. Their cash was being fully leveraged as both a tool to get them out of debt AND build a reserve of capital. Rather than putting their financial future in the hands of their credit card companies, our approach helped the Johnsons take control of their situation—with amazing results.

The Results

Paying off $135,000 in Debt with $80,000 in 33 Months

Applying the Tier 1 Capital Growth Process™ resulted in powerful outcomes for the Johnsons.

- They paid off their debts completely in 33 months—just over 2 years (rather than the 10+ years initially forecasted with traditional methods).

- They paid off $135,000 in consumer debt with just $80,000 because they were now able to recycle their debt payments through their whole life insurance policies.

- Their cash reserve helped them pay for the unexpected cost of a new furnace ($6,000) during their payoff period without going into further credit card debt.

- They remained financially secure during the ups and downs of the COVID-19 pandemic.

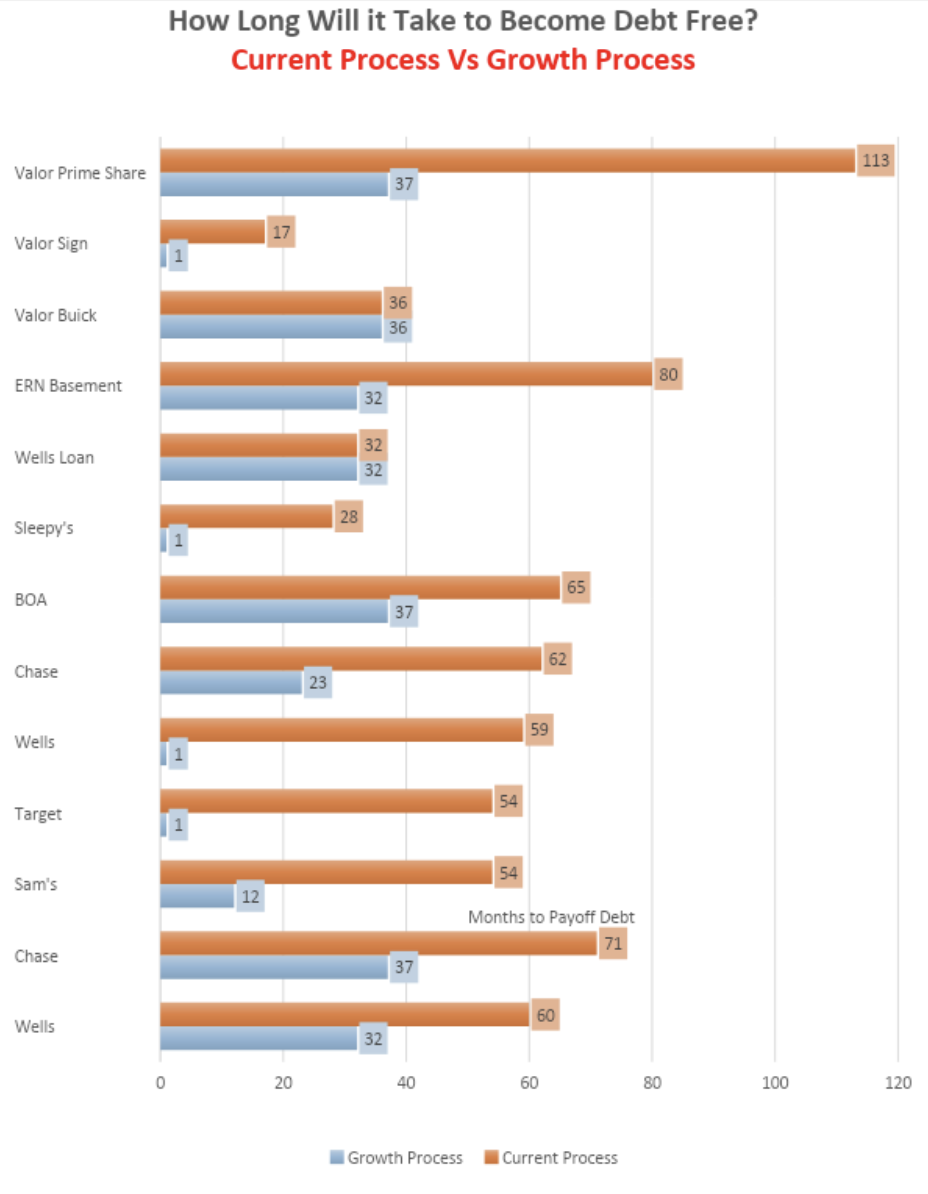

Debt Payoff Schedule

In just over 2 years from our first meeting, the Johnsons were debt-free and had a store of cash on the side. They had broken free of the debt cycle, were able to assist their son with college, and had the ability to resolve unexpected costs without going into additional debt. Where they had once been on the brink of filing for bankruptcy, Angela and Robert were finally free to consider their future again. And, for the first time in years, it was very bright.

Win By Default With Tier 1 Capital

Make Progress Now and in the Future by Owning Your Debt Cash Flow

It’s safe to say the Johnsons would never have been able to break out of the debt cycle if they had done things the conventional way. They would have gone from having no money and no cash flow to having cash flow and no money. Following the traditional “expert” way of doing things would have left them digging another hole of credit card debt the minute a new expense cropped up.

At Tier 1 Capital, the question we ask all of our clients is, “Are you making any progress?” Our approach is born from the belief that you CAN break the debt cycle, own your own debt, and repay yourself by recapitalizing your whole life insurance policy to gain financial freedom. It’s not enough to simply pay off your debt—you should have enough financial security to live your life like you want to, helping children pay for college, starting a business, or simply saving for retirement.

By using our method, you gain control of your debt cash flow and start winning by default. After all, anytime you can borrow from an entity YOU own and control—that you can redirect payments back into—you are going to win. Why? Because YOU (not the bank, not the credit card company) are in control of that financing function.

Putting you back in the driver’s seat is why we’re here. If you’re interested in getting back in control of your finances, learn more about who we are and what we do, or schedule a call with us.