What is Privatized Banking?

Privatized Banking is a method whereby one creates a pool of cash that can be used to finance one’s lifestyle, purchases, business ventures, and just about any expense.

What vehicle is used in the creation of a Privatized Banking System?

The Privatized Banking system is created by utilizing one or a series of mutual whole life insurance policies.

Why should I utilize Privatized Banking Strategies?

To help reduce or eliminate the expenses (Interest and other charges) associated with normal bank financing. The life insurance products used in Privatized Banking Strategies allow the tax free growth of cash value as well as distribution of dividends. Privatized Banking also creates a vehicle that can easily pass estates or wealth from one generation to the next without the penalties sometimes associated with gifting. Creating this cash reserve, or “Personal Bank” eliminates the need to apply for loans or fill out credit apps and/or a financial statement to prove that you are worthy of a loan from a conventional lending agency. In essence you are stockpiling the interest and fees that you’d normally pay for the privilege of the use of someone else’s money and creating your own “Personal Bank”. While at the same time earning the growth on that investment (in increased cash values) as well as the distribution of excess profits in the form of dividends.

Why use mutual whole life insurance?

Mutual whole life insurance as a contract has been in use for hundreds of years. As such it predates most tax laws which allow the growth and dividends to be earned income tax free. The growth in a mutual whole life insurance policy is guaranteed, unlike conventional market related investments that can go up or down. While the dividends themselves are not guaranteed, the companies that we work with have paid dividends regularly for over a hundred years.

Why does Tier 1 Capital create custom policies for each client?

Tier 1 Capital crafts individual policies for each client, designed for the unique needs of each situation. Each policy is designed for the maximum Privatized Banking opportunity, and as such is set up for faster cash value growth than most off the shelf policies.

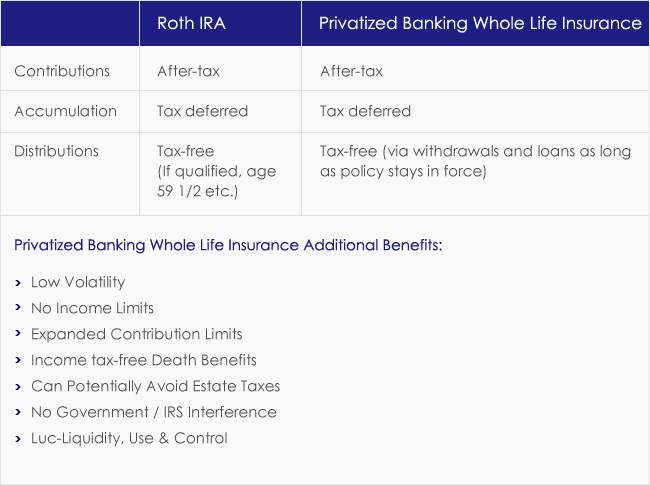

How are Privatized Banking Strategies different than a Roth?

The funds used to purchase a Roth are after tax dollars. The growth (or loss) of funds in a Roth are subject to the ups and downs of the stock market and as such are not guaranteed.With Privatized Banking Strategies the mutual whole life insurance policies are also purchased with after tax dollars. The growth that occurs inside the mutual whole life policy is income tax free. The growth in a mutual whole life insurance policy is guaranteed, unlike most Roth investments that can go up or down. While the dividends themselves are not guaranteed, the companies that we work with have paid dividends regularly for over a hundred years.

What are the advantages of Privatized Banking Strategies over mutual funds?

Mutual funds are typically invested in the stock market or some other non-guaranteed vehicle. We use mutual whole life policies for Privatized Banking. These policies have guaranteed growth and dividend potential. Mutual whole life policies also provide a death benefit.

What are the advantages of Privatized Banking over an annuity?

An annuity is a contract, sometimes in the form of an insurance policy, that once an investment is made will be paid out over a given time frame. These payments are a taxable event. In Privatized Banking, a retirement plan can be set up with payments, similar to an annuity. If structured properly, these payments can be tax free, and still allow the cash value to grow.

How can I get more information about Privatized Banking?

Tier 1 Capital, LLC is the place to come for an education in Privatized Banking Strategies. Get started by reading “Become Your Own Banker” or watching some of our videos then call or email us for a personal Privatized Banking Strategies session.

Is there a minimum amount of dollars to get started?

You can start with a monthly premium, or an annual premium. There is no minimum.

Do I have to do an annual premium or can I go monthly?

Either will work.

How secure are the companies that you deal with?

We deal with mutual life insurance companies that have been in existence for over a hundred years. These companies have a track record of paying dividends to all whole life policy holders consistently for over 100 years as well. Unlike banks, who only have to have enough cash reserves to cover 1/10 of their deposits ($1 for every $10), mutual life insurance companies must match dollar for dollar all the money invested in their policies thus making these companies more sound than most banks.

I’ve heard that once you start a policy, you are hooked into payments for life. True or False?

False. Mutual whole life policies grow faster with payments for life. They do not have to be structured that way. Several people opt for the paid up in 10 or 20 year plan. This is why we will custom craft a policy for you and your budget. We want this program to be successful for you.

Is it true that premiums increase as you get older?

With term insurance, premiums increase as the insured gets older. Term insurance doesn’t gain in cash value either. For these reasons, we use only mutual whole life policies. These policies have a fixed payment structure. You’ll know before you sign up what the terms are and how much the payments will be. Once the contract is set, it cannot be changed by the insurance company.